Category: All

-

Bitcoin has transformed from a niche experiment into a financial powerhouse, revolutionizing how we store, transfer, and think about money. As the leading cryptocurrency, Bitcoin’s role in 2024 is more significant than ever. Let’s explore its current state, potential, and how you can take advantage of its opportunities. The Bitcoin Basics: Why It’s Still King…

-

Bitcoin continues to dominate headlines as it redefines the way we think about money, value, and technology. This digital currency has transcended its roots as an experimental asset and is now a cornerstone of the global financial system. Whether you’re a seasoned trader or just starting your journey, understanding Bitcoin in 2024 is crucial. What…

-

Bitcoin isn’t just a currency; it’s a paradigm shift in how value and trust are managed in a digital age. Whether you’re an investor, a tech enthusiast, or someone curious about its impact, understanding Bitcoin’s evolution in 2024 is essential. Let’s dive into what makes Bitcoin revolutionary and how you can leverage its potential. The…

-

The Bitcoin story goes far beyond price speculation—it’s reshaping how we think about value, trust, and technology. As we explore its ongoing evolution, here are some powerful reasons why Bitcoin is a cornerstone of the digital financial future. Bitcoin’s Role in Global Finance Bitcoin has become a game-changer in the financial system, particularly in regions…

-

Bitcoin, the world’s first cryptocurrency, remains a revolutionary force in the financial world. As we head deeper into 2024, Bitcoin’s adoption continues to accelerate, driven by growing institutional interest, innovative blockchain applications, and its powerful role as a hedge against inflation. What is Bitcoin? Bitcoin (BTC) is a decentralized digital currency launched in 2009 by…

-

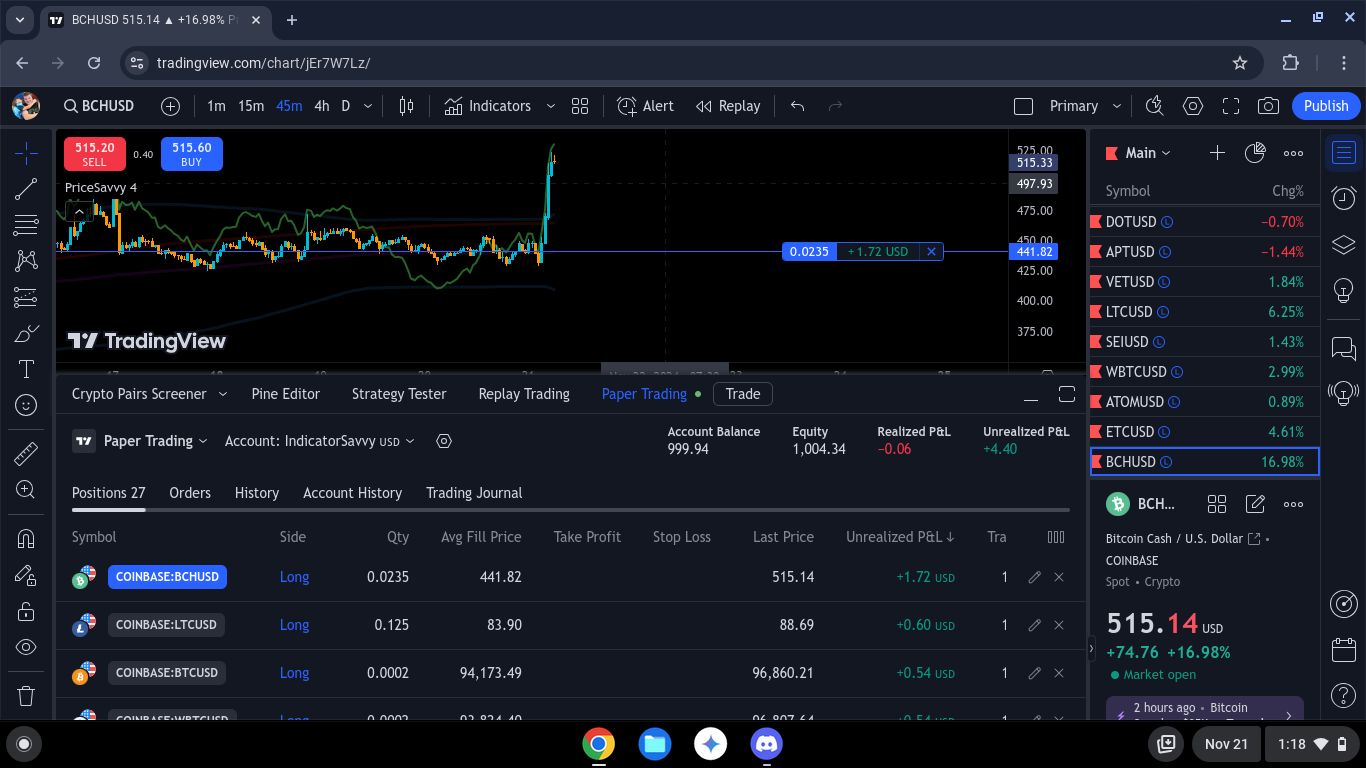

Paper trading is a cornerstone practice for anyone serious about algorithmic or Intellinomic trading and investing. Whether you’re just starting out or a seasoned trader refining your edge, running parallel paper trades alongside live trades is an invaluable strategy. Why? Because it not only hones your alpha but also encourages you to engage in light…

-

Williams %R, developed by Larry Williams, is a momentum oscillator that measures overbought and oversold levels in a market. Unlike other oscillators, Williams %R compares the closing price of a security to its high-low range over a specific period, typically 14 days. By understanding how to use Williams %R, traders can identify potential reversal points,…

-

The Commodity Channel Index (CCI) is a versatile technical analysis tool that helps traders identify cyclical trends in a wide range of markets, not just commodities. Developed by Donald Lambert in 1980, the CCI measures the difference between a security’s current price and its historical average price, providing insights into whether the asset is overbought…

-

Chaikin Money Flow (CMF) is a volume-based indicator that measures the buying and selling pressure over a specified period, typically 20 or 21 days. Developed by Marc Chaikin, CMF helps traders understand whether a security is being accumulated (bought) or distributed (sold) by analyzing both price and volume. By incorporating CMF into your trading strategy,…

-

The Parabolic SAR (Stop and Reverse) is a trend-following indicator developed by J. Welles Wilder, Jr., designed to identify potential reversal points in the price movement of an asset. The Parabolic SAR provides clear buy or sell signals based on the direction of the trend, making it a valuable tool for setting stop-loss levels and…

Share our blog with your colleagues.

We work hard to keep it updated.

What You’ll Find:

- Tutorials

- Analysis and News

- Culture and Tech

- Math and Economics

How to Navigate:

Use the search function to find things like “Relative Strength Index” or “RSI.”