-

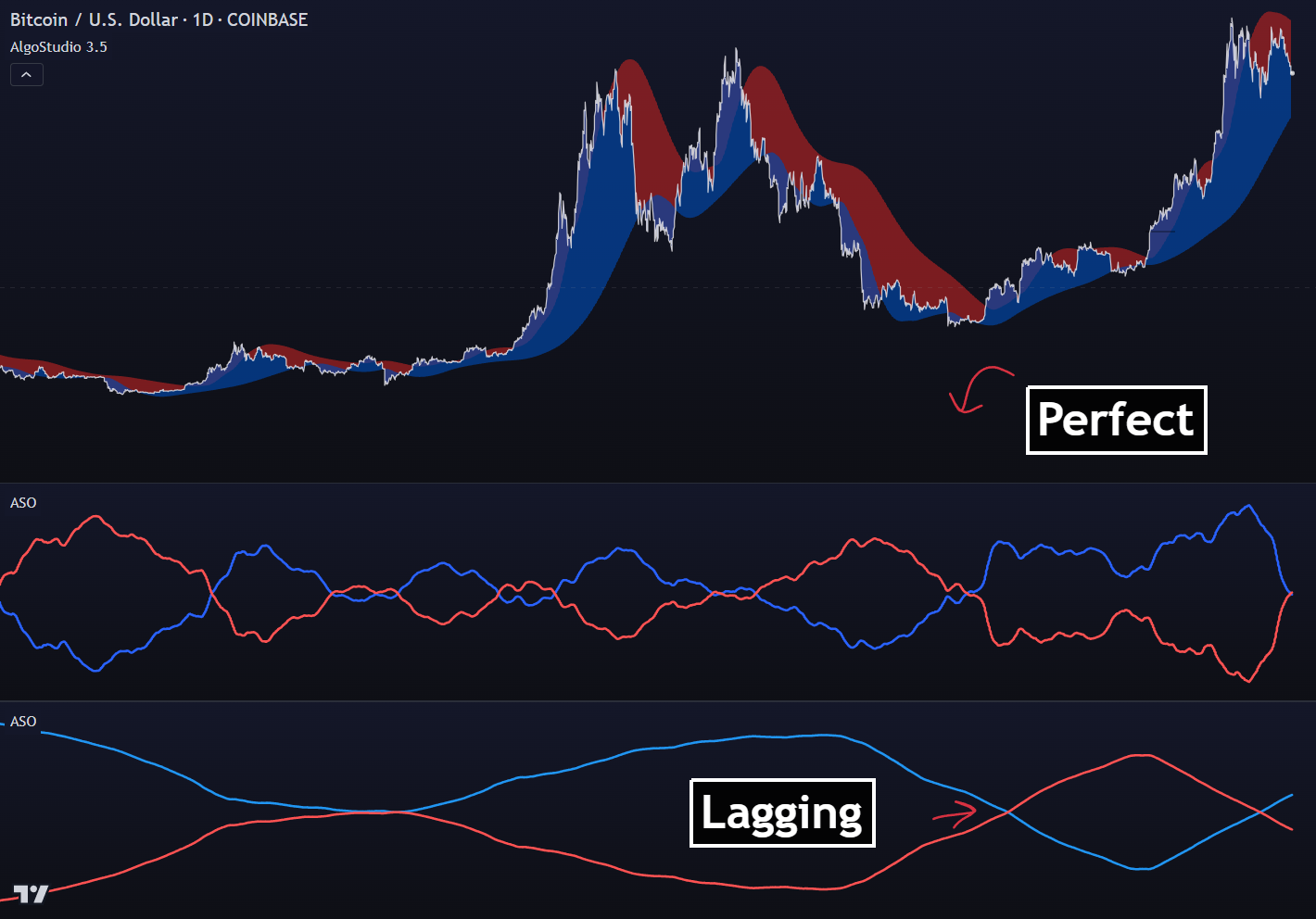

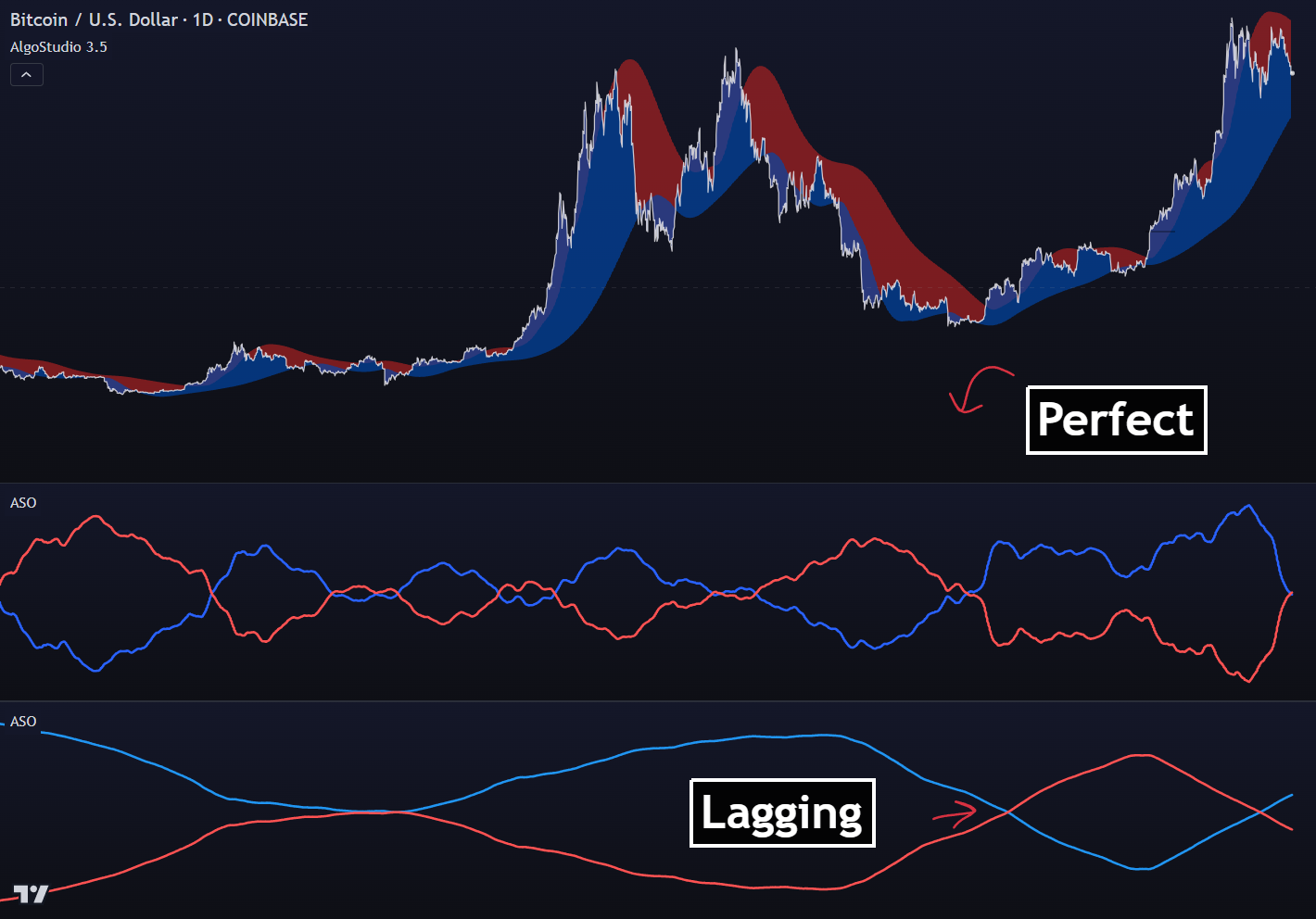

The Average Sentiment Oscillator used to be one of my favorite indicators back when I was getting started. Today, we’re going to be rebuilding the indicator from scratch and making it more mathematically sound.

The Average Sentiment Oscillator used to be one of my favorite indicators back when I was getting started. Today, we’re going to be rebuilding the indicator from scratch and making it more mathematically sound.